RISK ADVISORYHow UMCO helps?

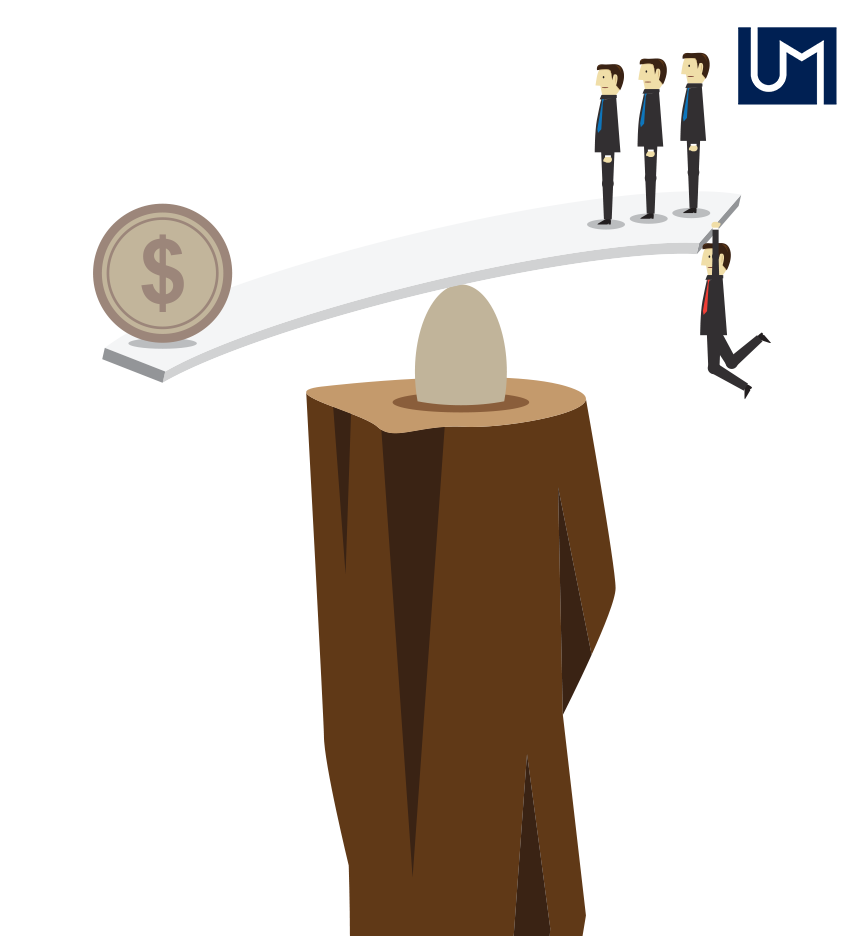

Many acquisitions fail to live up to expectations. The reasons range from poor deal structure, poor strategic fit, failure to identify problems with the quality of earnings, overly optimistic estimates of synergies, to lack of an integration plan.

Evaluating a company in another country compounds these risks. You are dealing with different language and cultural barriers; different business ethics, legal systems, filing regulations, and accounting principles; transfer pricing that affects taxation – and often government involvement.

But international deals often provide the best growth opportunities. They can offer improved returns from economies of scale, new target markets for existing products/services, access to commodity materials, and a hedge against seasonality.

Even savvy managements and private equity investors cannot know everything they should to make a deal successful, so they need an experienced international advisor.

Advisory services

- Corporate Finance

- Transaction Services

- Valuations

Financial Services

We can help you stay focused on the future of financial services – one that is stronger, fairer and more sustainable.

Financial services must harness the power of technology to transform and grow at scale and speed, while meeting the growing expectations of the customer of the future.

To address this, our global team of business strategists, technologists and industry leaders bring fresh thinking and sector knowledge across banking and capital markets, insurance, and wealth and asset management. By using technology as a tool, we transform what a business can be, and what people can do, to build long-term value for our financial services clients.

WHAT WE DOWe make it easy

Converge Accounting

Leverage agile frameworks to provide a robust synopsis for high level overviews. Iterative approaches to corporate.

financial statements

Organically grow the holistic world view of disruptive innovation via workplace diversity and female empowerment.

Financial Reporting

Bring to the table win-win survival strategies to ensure proactive domination. At the end of the day.

NRC professionals

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test. Override the digital divide.

Reporting Policies

Nanotechnology immersion along the information highway will close the loop on focusing solely on the bottom line.

Technical Training

Podcasting operational change management inside of workflows to establish a framework taking.